In social media apps, if a "Like" doesn’t register instantly, it’s usually a small UX issue. If a comment disappears, it’s an annoying bug.

But in FinTech, the bar is different: reliability is the user experience.

Coming from a background in Taxation and Accounting before moving into Software Development, I learned one rule early: the books must always balance. Finance leaves no room for “close enough.”

When I started building financial applications, I realized that much of this trust is protected by a simple (but powerful) database idea: ACID.

Instead of only defining it, let’s see what ACID does in the moments that matter most—especially when systems fail in the real world.

The Scenario: A Split-Second Interruption

Let’s imagine a simple transfer: I (Anand) am sending ₹5,000 to Khushi.

At a minimum, it’s two actions:

- Debit: Subtract ₹5,000 from Anand’s account.

- Credit: Add ₹5,000 to Khushi’s account.

Now imagine the power fails or the server crashes exactly one millisecond after Step 1.

🌱 Without Strong Transaction Guarantees

If a system updates data step-by-step without a true database transaction, here’s what can happen:

- 10:00:00 AM: ₹5,000 is debited from Anand’s account.

- 10:00:01 AM: Interruption! The database goes offline before it can credit Khushi.

- 10:05:00 AM: The system comes back online.

What users experience:

I see: “₹5,000 Debited.”

Khushi sees: “No funds received.”

This is exactly why financial systems invest so heavily in correctness: even a rare edge case can create confusion and support load.

✅ With ACID (The Reliability Safety Net)

Now let’s replay the same interruption with ACID enforced.

- 10:00:00 AM: The system starts a database transaction and attempts the debit.

- 10:00:01 AM: Interruption! The server dies before the credit completes.

- 10:05:00 AM: The database restarts and checks its transaction log (WAL/redo log) for incomplete work.

What happens next: Because of Atomicity, the database automatically rolls back the incomplete transaction. The debit is undone, and my balance returns to its original value.

User outcome: the transfer simply fails safely, and I get a clear message like:

“Transaction failed. Please try again.”

No money is “stuck between steps.” That’s the trust ACID is designed to protect.

The Breakdown: How ACID Builds Credibility

Here’s how each ACID property protects real-world financial flows.

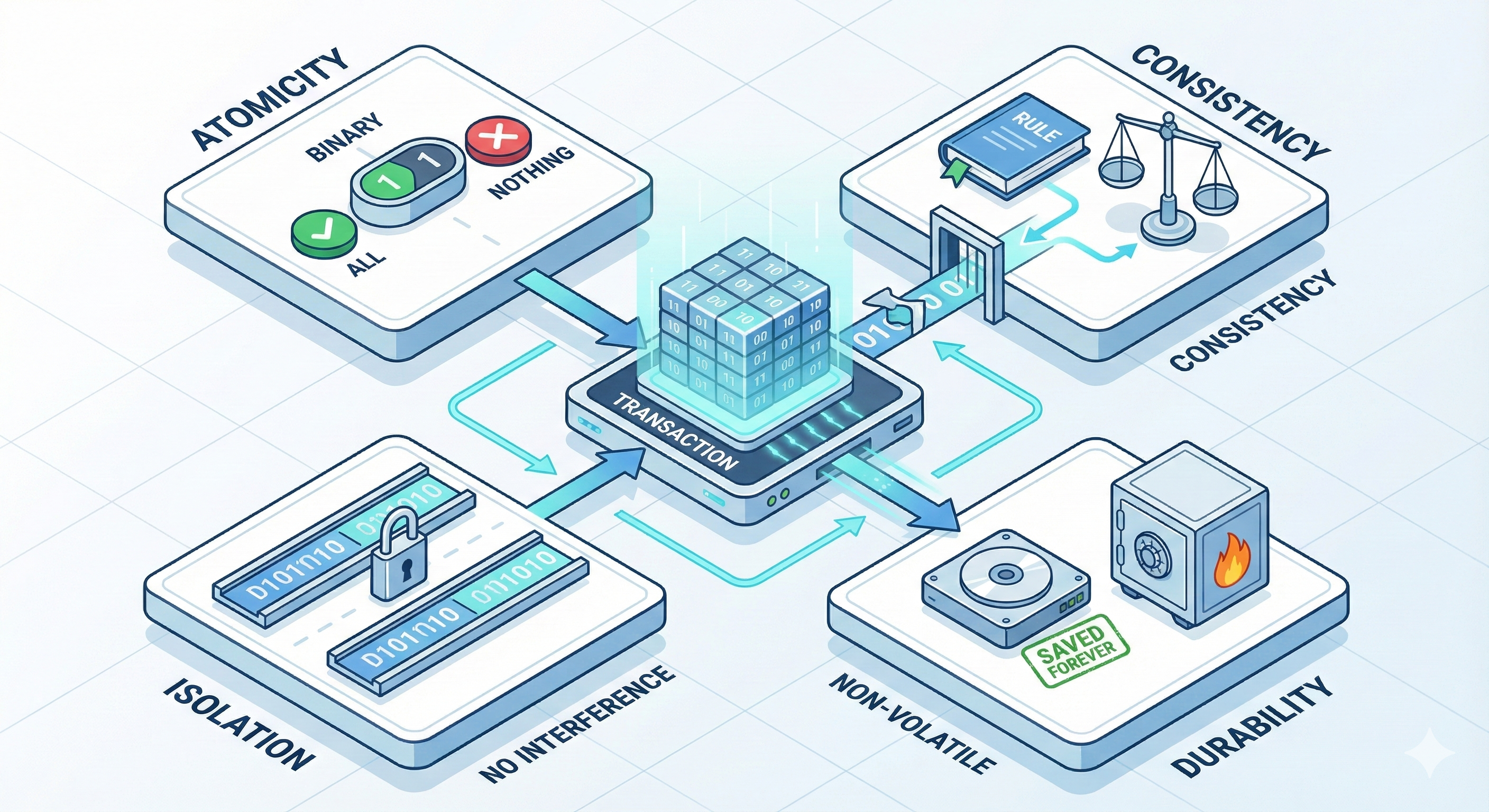

A — Atomicity (All-or-Nothing)

In FinTech, a transfer is only successful if every step succeeds.

Atomicity guarantees that a transaction is a single unit:

- Either all steps happen, or

- none of them do.

So users don’t end up paying for something they didn’t receive.

C — Consistency (Rules Always Hold)

Example: if an account has ₹100, the system should never allow a transfer of ₹500 that results in -₹400.

Consistency means the database only moves from one valid state to another. Constraints and validation rules ensure that if an operation violates business rules (like “balance cannot go negative”), the transaction is rejected and the data remains correct.

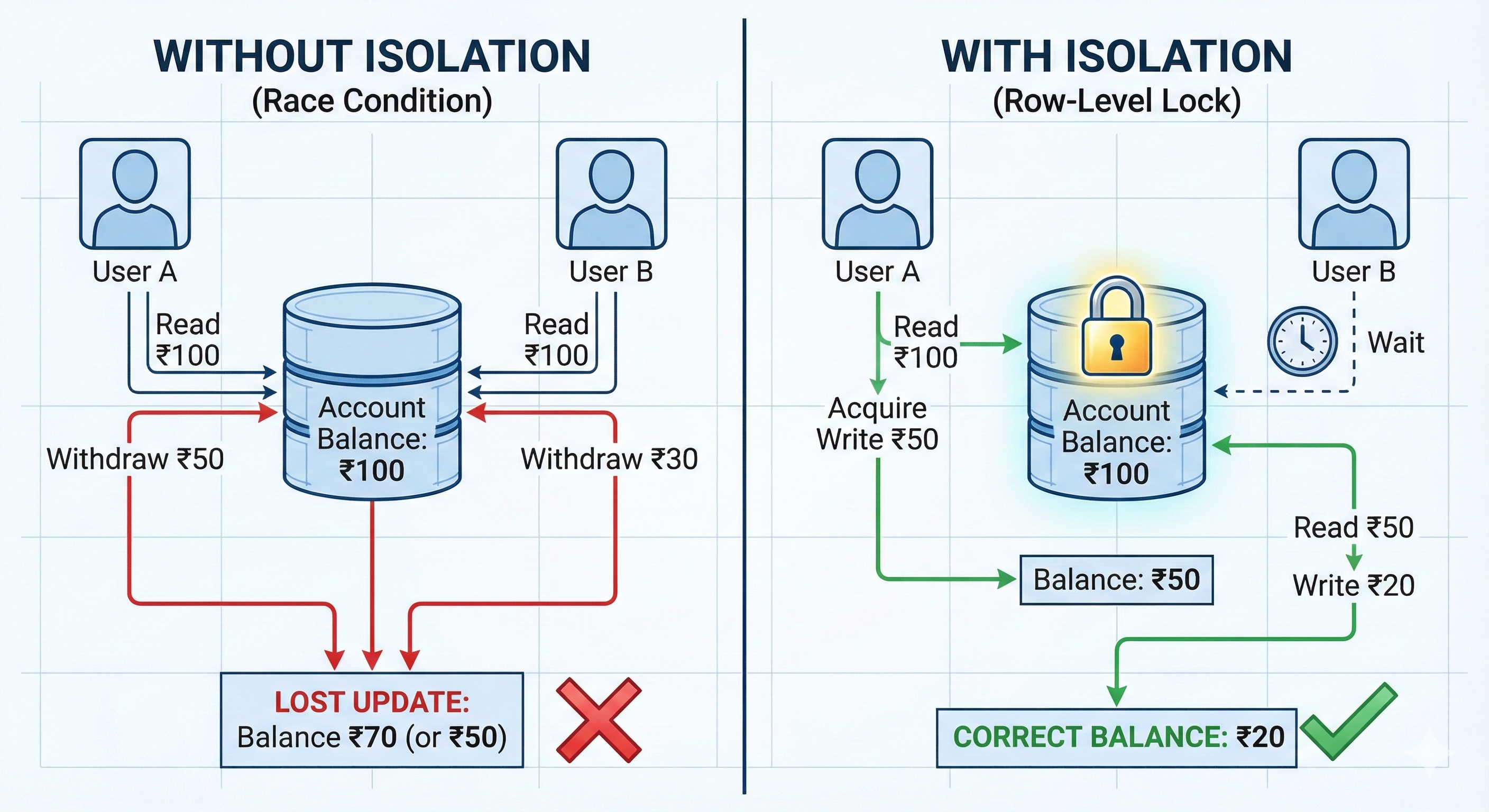

I — Isolation (Correct Under Concurrency)

Financial systems run many transactions at once.

Without isolation: two operations can read the same old balance and overwrite each other (a classic lost update problem).

With isolation: the database uses mechanisms like row-level locks and/or MVCC (depending on the DB and isolation level) so concurrent transactions don’t interfere and the result stays accurate.

D — Durability (Success Means Permanent)

When the system says “Success!”, it should mean the record is safely stored.

Durability ensures that once a transaction is committed, it is persisted to non-volatile storage (via logs + flushed pages). Even if the server restarts right after, the committed result can be recovered.

Conclusion: In FinTech, ACID is UX

In many apps, UX means animations, loading speed, and smooth flows.

In FinTech, UX also means one critical promise:

If the app confirms a transaction, it stays correct—always.

That’s why ACID isn’t just a database concept. It’s a credibility layer.

If you’re building systems where trust is the currency, let’s connect.

- Email: anand.thakkar@outlook.com

- LinkedIn: Anand Thakkar

Have you ever seen a transfer briefly look “stuck” and then resolve later? Often, that’s transactional recovery doing its job behind the scenes. Share your story below.